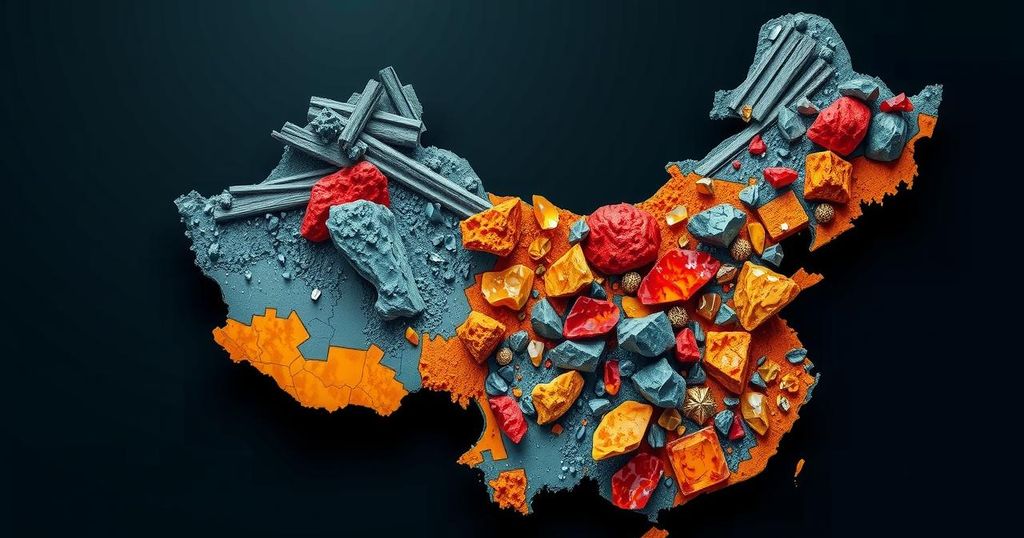

China’s Dominance in Critical Minerals Threatens U.S. Supply Chain Stability

Chinese companies currently control two-thirds of the cobalt produced in the Democratic Republic of the Congo, which accounts for 74 percent of the world’s output. This dominance presents a risk to U.S. supply chain de-risking efforts under the Inflation Reduction Act due to potential classifications of these entities under the foreign entity of concern clause. A study by Benchmark Minerals indicates that 60 percent of the cobalt supply by 2024 could be impacted by this legislation.

China’s significant holdings in critical minerals pose a substantial threat to the United States’ supply chain stability, particularly in the context of the U.S. Inflation Reduction Act (IRA) which aims to foster domestic production and reduce reliance on foreign entities. A recent study highlights that Chinese firms oversee an astounding two-thirds of the cobalt market in the Democratic Republic of the Congo (DRC), a nation that produces approximately 74 percent of the world’s cobalt supply. This oversight places these companies at a heightened risk of being categorized under the foreign entity of concern clause outlined in the IRA. One notable entity, CMOC (previously known as China Molybdenum), is recognized as a leading cobalt producer, operating critical mining sites in the DRC, including the Tenke Fungurume mine and the Kisanfu project. The implications of the foreign entity of concern clause are significant, as it is estimated that by 2024, 60 percent of the mined cobalt supply is likely to originate from sources that may fall within this high-risk classification. According to Benchmark Minerals, these sources are potentially subject to increased scrutiny under the U.S. law, particularly those owned or controlled by nations such as China, Russia, Iran, and North Korea.

The increasing reliance on critical minerals like cobalt, crucial for various technological and green energy applications, underscores the strategic importance of global supply chains. The U.S. government’s Inflation Reduction Act aims to bolster domestic production while reducing dependence on foreign sources, particularly those perceived as adversarial. However, China’s dominant position—especially in cobalt production from the DRC—complicates these efforts, raising concerns about supply chain security and the stability of future technological advancements reliant on these minerals.

In summary, China’s control over the majority of the global cobalt supply presents a formidable challenge to the United States’ aspirations for supply chain independence, particularly under the constraints of the Inflation Reduction Act. The potential classification of significant portions of this supply as foreign entities of concern could impede progress towards a self-sufficient and secure supply chain in critical minerals.

Original Source: www.scmp.com