Talanx Group Issues First $100 Million Catastrophe Bond for Chile Earthquake Risks

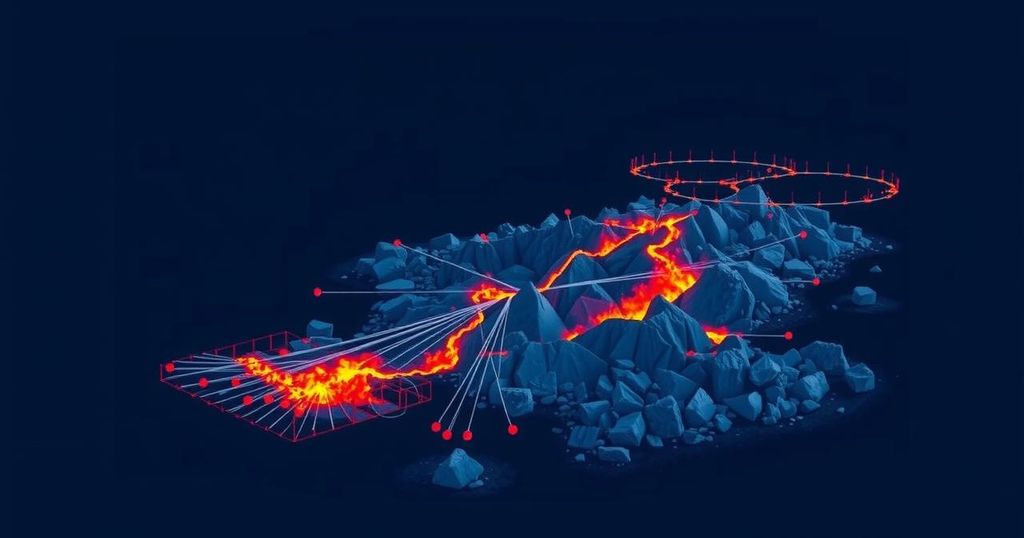

Talanx Group has issued its first catastrophe bond valued at USD 100 million for earthquake risks in Chile. This bond was established in collaboration with Hannover Re and will provide coverage from January 2025 to December 2027. The structure of the bond is parametric, linking payouts to earthquake severity, showcasing Talanx’s strategy to diversify its reinsurance approach while leveraging capital markets for risk management.

Talanx Group, the parent entity of Hannover Re, has made a significant advancement in its risk management strategy by issuing its inaugural catastrophe bond. Valued at USD 100 million, this bond addresses earthquake risks specifically in Chile and was launched through Maschpark Re Ltd., a Bermuda-based special purpose insurer in collaboration with Hannover Re. This issuance reflects Talanx’s commitment to enhancing its reinsurance protection in regions where it holds a robust market share.

Dr. Jan Wicke, Chief Financial Officer of Talanx AG, emphasized the company’s sustained growth and the corresponding necessity for increased reinsurance safeguards. He stated that the catastrophe bond effectively transfers risk to the capital markets while diversifying their traditional reinsurance programs. Dr. Wicke expressed gratitude for Hannover Re’s support, recognizing their expertise in Insurance-Linked Securities (ILS) and catastrophe bond markets.

Silke Sehm, a member of Hannover Re’s Executive Board overseeing Property & Casualty reinsurance, highlighted the firm’s legacy, noting their pioneering efforts in risk securitization three decades ago. She remarked on Hannover Re’s evolving role as a leader in the ILS market, providing substantial support to both existing partners and new clients, including Talanx.

The bond offers protection to Talanx from January 2025 to December 2027, utilizing a parametric structure wherein payouts are contingent upon the magnitude of earthquakes in the designated area. The transaction was facilitated by Aon Securities LLC and GC Securities, a division of MMC Securities LLC, marking a notable development in Talanx’s reinsurance portfolio.

The issuance of catastrophe bonds represents a strategic move for insurance companies like Talanx Group, which seeks to manage its exposure to risks associated with natural disasters, particularly earthquakes in regions with significant market presence. Catastrophe bonds enable insurance providers to transfer risk to capital markets, tapping into investor funding to bolster their financial resilience against unforeseen events. This approach not only diversifies traditional reinsurance functions but also aligns with the increasing global focus on innovative risk management solutions.

In summary, Talanx Group’s issuance of its first catastrophe bond signifies a proactive approach to managing earthquake risks in Chile, demonstrating the company’s commitment to utilizing innovative financial instruments for risk diversification. This strategic decision, supported by Hannover Re’s extensive expertise, positions Talanx to enhance its reinsurance capabilities while securing vital coverage for its operations over a multi-year period. The move is indicative of a broader trend in the insurance industry towards integrating capital market solutions in risk management.

Original Source: www.reinsurancene.ws