Talanx Issues $100 Million Catastrophe Bond to Mitigate Chile Earthquake Risks

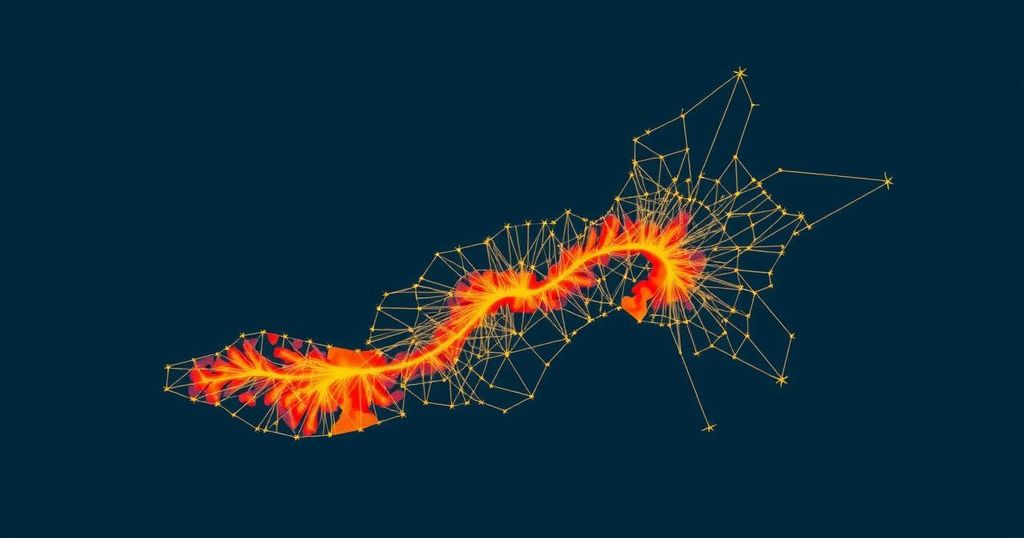

Talanx Group has launched its first catastrophe bond worth $100 million, providing multi-year earthquake risk protection in Chile. Issued via Maschpark Re Ltd and in collaboration with Hannover Re, the bond enhances Talanx’s reinsurance framework. Notably, it employs a parametric trigger, allowing for quicker payouts based on seismic activity rather than assessed damages, ensuring alignment with Talanx’s risk management strategies.

Talanx Group, a prominent entity in the global insurance space, has successfully issued its inaugural catastrophe bond, aimed at bolstering protection against earthquake risks in Chile. The bond, valued at $100 million, was placed via Maschpark Re Ltd, a special purpose insurer based in Bermuda, in conjunction with Talanx’s subsidiary, Hannover Re. Dr. Jan Wicke, the Chief Financial Officer of Talanx AG, articulated that this move enhances the company’s reinsurance framework in Chile, a pivotal market for Talanx.

“We are a global insurance group enjoying ongoing growth and hence have an increased need for reinsurance protection,” stated Dr. Wicke. He emphasized the strategic importance of their enhanced mitigation against seismic risks in Chile, highlighting the bond’s role in diversifying traditional reinsurance methods by transferring risk to the capital markets. Significantly, Hannover Re’s expertise played an instrumental role in the bond’s structuring, showcasing their leadership in the insurance-linked securities and catastrophe bond markets.

Silke Sehm, a member of Hannover Re’s executive board, noted their pioneering legacy, stating, “Since placing the world’s first risk securitization 30 years ago, Hannover Re has amassed in-depth expertise in transferring insurance risk to the capital markets.” The catastrophe bond provides coverage for Talanx from January 2025 to December 2027, employing a parametric trigger mechanism. This method ensures that payouts are linked to earthquake magnitude rather than the extent of physical damages, thereby facilitating swifter payouts based on set criteria that are in line with Talanx’s risk management approach in Chile, a nation frequently experiencing seismic activity.

The issuance of this bond was successfully coordinated by Aon Securities LLC and GC Securities, a division of MMC Securities LLC, further highlighting a collaborative effort towards enhancing Talanx’s risk management portfolio.

The issuance of catastrophe bonds represents a strategic advancement in the risk management methodologies adopted by insurance firms. These financial instruments allow insurers to transfer substantial risks, particularly associated with natural disasters, to capital markets. In this context, Talanx’s decision to enter the catastrophe bond market underscores the pressing need for robust reinsurance solutions in regions prone to seismic activities, such as Chile. These bonds not only provide financial protections but also facilitate faster claims processes, thereby enhancing the resilience of insurance operations in volatile environments.

In summary, Talanx’s issuance of a $100 million catastrophe bond represents a significant step in expanding its earthquake risk protection in Chile. With key collaborations with Hannover Re, Aon Securities LLC, and GC Securities, the bond reflects a modern approach to risk management through the utilization of capital markets. The parametric trigger mechanism allows for expedited payouts following seismic events, thereby reinforcing Talanx’s commitment to effective risk mitigation in a seismically active region.

Original Source: www.insurancebusinessonline.com.au