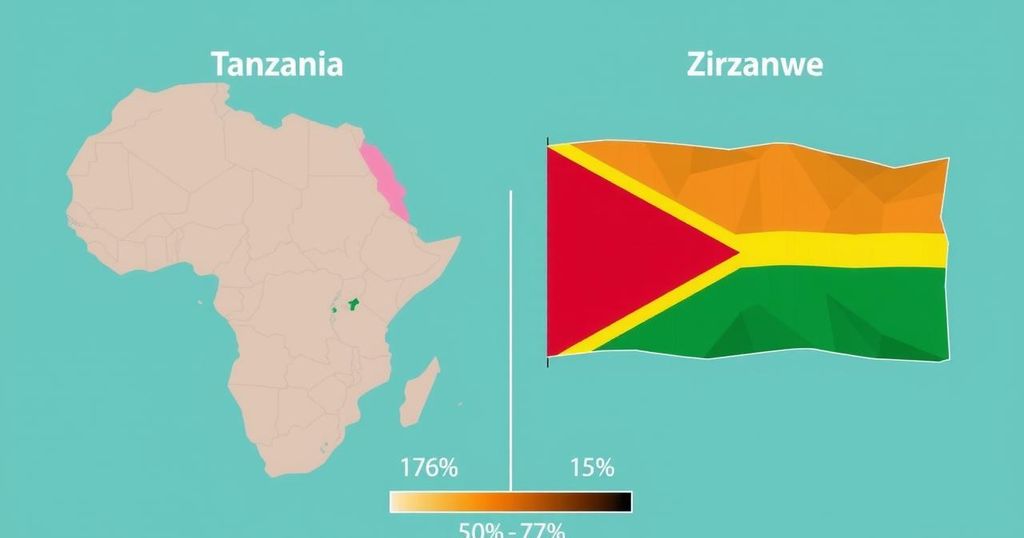

Contrasting Approaches to Digital Payments: Lessons from Tanzania and Zimbabwe

Tanzania has eliminated charges on card payments to boost digital transactions and promote a cash-lite economy, contrasting with Zimbabwe, where a 2% tax on electronic transactions has reversed progress towards digital payments. This disparity raises questions about the sustainability and future of digital financial systems in both countries as Zimbabwe continues to rely heavily on cash transactions due to the financial burdens imposed by the government.

Recent developments in Tanzania concerning digital payments stand in stark contrast to the situation in Zimbabwe. The Tanzanian government has eliminated transaction charges on card payments to encourage a cash-lite economy, making strides in financial inclusion and enhancing the security and convenience of digital transactions. In a nation where 48.4% of the population now utilizes digital platforms, this initiative by the Bank of Tanzania marks a significant shift toward embracing electronic payments.

In comparison, Zimbabwe has fallen back into a cash-oriented economy, primarily due to the introduction of a 2% Integrated Money Transfer Tax (IMTT) in 2018, a move that aimed to capitalize on its burgeoning digital payment system. This tax, initially intended to generate revenue from the growing electronic transactions, has instead led to a substantial decline in their use, with individuals now largely preferring cash to evade the associated costs. Zimbabwe’s experience highlights the detrimental effects of government greed on the adoption of digital payment methods.

By revisiting Tanzania’s approach, one may ponder the potential impact a similar strategy could have on Zimbabwe if it were to abolish transaction fees. Such a reform could not only mitigate the burden on citizens but also foster a more robust and inclusive digital economy. However, significant challenges remain, including the heavy reliance of banks and payment providers on transaction fees, which complicates the landscape of digital payments in the country.

The tale of Tanzania and Zimbabwe serves as a poignant reminder of how government policies can either promote or hinder technological progress in financial systems. The journey toward a cash-lite economy is fraught with challenges, but the path forward may yet be illuminated by keen observation of neighboring nations and their strategies.

The article contrasts the evolving payment landscapes in Tanzania and Zimbabwe, shedding light on the differing governmental approaches to digital transactions. In Tanzania, the Bank of Tanzania has actively sought to promote digital payments by removing transaction fees. This initiative has coincided with rising smartphone usage and financial inclusion among the population, thus fostering a cash-lite economy. Conversely, Zimbabwe’s economic landscape has shifted toward cash due to the imposition of a tax on electronic transactions, which has discouraged consumers from utilizing digital payments. This contrast provides a study of how government intervention can significantly influence payment systems and consumer behavior in the digital age.

In conclusion, the policies adopted by Tanzania present a model for fostering a cash-lite economy through the removal of transaction charges on digital payments. Conversely, Zimbabwe’s experience underscores the potential pitfalls of government intervention in the form of excessive taxation on electronic transactions. Such taxation not only deters the adoption of digital payments but also forces a retreat into cash-based transactions. Moving forward, careful consideration of these policies could inform strategies that empower consumers and facilitate the growth of digital financial ecosystems.

Original Source: www.techzim.co.zw