Atlantic Storms of 2024: Impact on Insurance and Major Legal Developments

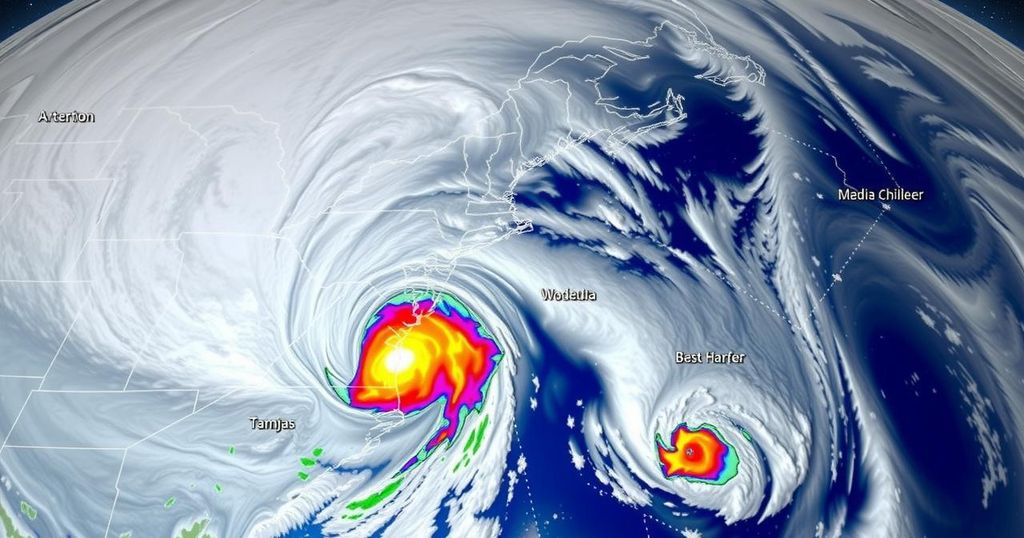

The year 2024 has been heavily influenced by significant Atlantic storms, leading to over $258 billion in economic losses and $102 billion in insured losses. Hurricane Milton alone resulted in approximately 221,582 claims costing around $2.7 billion. Global weather events in Spain and Taiwan further demonstrated the widespread impact of extreme weather. Concurrently, high-profile lawsuits involving major corporations also captured widespread attention.

In 2024, the insurance landscape was heavily influenced by a multitude of storms that lashed both domestic and international regions, leading to significant economic and insured losses. The Atlantic hurricane season proved to be particularly intense, with notable storms contributing to over $258 billion in economic losses and $102 billion in insured losses as reported by Aon plc. The impact of Hurricane Milton in Florida alone resulted in over 221,000 claims and a staggering estimated insured loss of $2.7 billion, with flood damage affecting approximately 185,000 structures throughout the state.

The broad repercussions of these disasters prompted regulators in both Tennessee and Florida to implement measures to monitor insurance claims closely. Tennessee is demanding comprehensive reporting from insurers regarding claims emerging from Hurricane Helene, while Florida’s Hurricane Catastrophe Fund anticipates a payout of around $4.6 billion to cover insurer losses from the storms without generating additional surcharges on premiums. Despite these significant financial impacts, ratings agencies indicated that Florida-based carriers would maintain overall capital stability.

Globally, the effects of extreme weather were similarly devastating. Severe storms in Spain, particularly in Catalonia, resulted in significant flooding and chaos within the transportation sector, leading to projected insurance losses exceeding €3.5 billion ($3.8 billion). The powerful typhoon Kong-rey intensified the economic toll as it disrupted trading in Taiwan and inflicted substantial agricultural damage across multiple regions, showcasing the widespread nature of the crisis.

In addition to storm-related insurance issues, high-profile legal disputes captured public attention this year. Notable among these were lawsuits involving Meta Platforms Inc. over alleged data exploitation, as well as litigations against Abbott Laboratories concerning the safety of their infant formulas. These stories, as well as others linked to well-known brands, provided readers with a diverse array of content reflecting the year’s tumultuous events in both insurance and legal arenas.

The focus of the article revolves around the severe weather events of 2024 that had profound effects on both the insurance industry and economic landscapes. The Atlantic hurricane season was marked by unprecedented storms that raised the stakes in claims and losses, resulting in large-scale reporting by claims-related outlets. Additionally, global disasters highlighted the connections between intense weather phenomena and substantial financial repercussions for various regions, emphasizing the relevance of monitoring and regulating insurance claims amidst such calamities. The legal incidents offer another dimension, illustrating the intersection of natural disasters with corporate accountability and consumer rights.

In summary, 2024 has been a year dominated by significant storms that have not only generated immense economic and insured losses but also prompted accountability measures among insurers in affected regions. Florida and Tennessee have taken proactive steps to address the aftereffects of hurricanes, while global storms underscore the increasing frequency and severity of natural disasters impacting economies worldwide. Concurrently, high-profile lawsuits emphasize the interconnectedness of corporate responsibility and public safety, leading to heightened scrutiny within the legal and insurance fields.

Original Source: www.claimsjournal.com