Steady Trade Finance Revenue in Europe; Growth in Middle East and Brazil

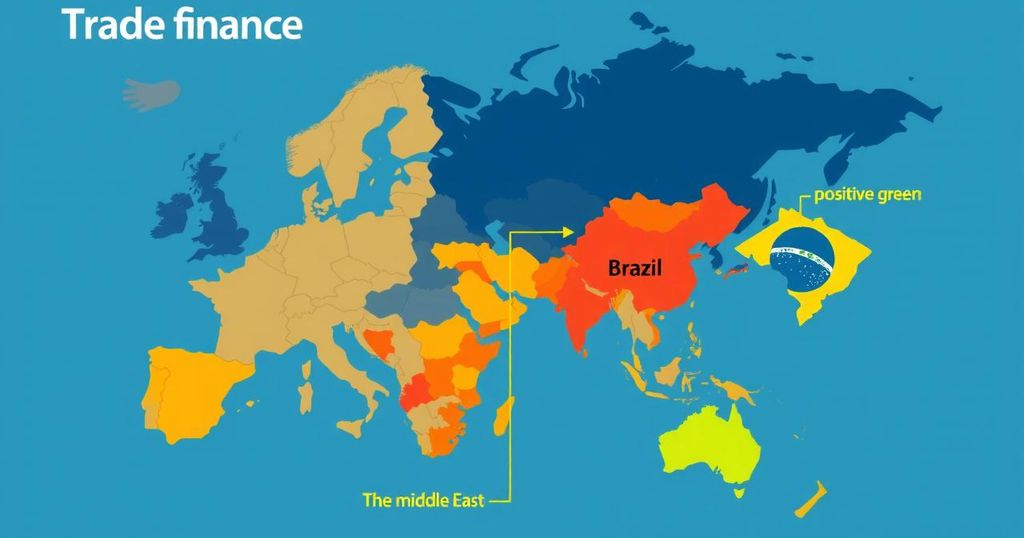

Despite stable overall trade finance revenue, the Middle East and Brazil experienced significant growth in 2024, while European banks reported varying results. The future remains uncertain due to US trade policies, but some banks are optimistic about intra-regional opportunities, particularly in Asia.

Trade finance revenue reported by banks has remained consistent, with notable growth observed in specific regions such as the Middle East and Brazil. According to a review by GTR, while European and Asian banks reported stable earnings or minimal declines, the overall sentiment regarding trade finance in Europe seems more optimistic than in 2023. Uncertainties surrounding US trade policies, particularly under the Trump administration, pose challenges for both importers and exporters.

The World Trade Organization indicated that trade performed well in late 2024; however, the outlook for 2025 remains murky due to potential shifts in trade policies. Despite the uncertain backdrop, some banks, especially in Asia, anticipate opportunities arising from disruptions in US trade. DBS Bank plans to focus on trade opportunities with North Asia and Europe, while Standard Chartered sees potential for growth in its Asian markets.

It is worth noting that discrepancies exist in how banks report their trade finance earnings, with large US and European banks often failing to provide specific income figures related to trade activities. Consequently, the findings from GTR primarily reflect large lenders and major markets, which may not capture the entire global trade finance landscape.

In Europe, HSBC’s Global Trade Solutions division reported a modest revenue increase of 1% to U.S. $1.99 billion in 2024, bolstered by higher fee income from guarantees. Standard Chartered’s trade finance income declined by 2% to U.S. $1.27 billion, attributed in part to weaker margins. Société Générale and BNP Paribas demonstrated stable volumes in trade finance, while Natixis experienced positive momentum that resulted in increased revenue.

In Singapore, DBS Bank’s trade income decreased by 4% to S$638 million due to lower average volumes. However, they identified potential growth opportunities with Regional Comprehensive Economic Partnership countries. Meanwhile, OCBC reported a slight decline in trade-related income but noted growth in trade loans, while UOB highlighted a 20% increase in trade loans compared to 2023.

Middle Eastern banks, particularly in the UAE and Saudi Arabia, reported solid earnings. First Abu Dhabi Bank’s trade finance commission income jumped 17% to AED 1 billion, while Abu Dhabi Commercial Bank saw improved trade finance commission income. In Saudi Arabia, both SAB and Saudi National Bank exhibited significant growth in trade-related revenues, indicating their critical role in overall banking income.

In the Americas, Brazilian banks continued a positive trend in trade finance, with Bradesco observing a more than 50% increase in foreign trade finance. Banco do Brasil and Itaú Unibanco also reported substantial growth in trade-related income and loans. In contrast, Citi in the US was the only significant lender to delineate its trade finance revenue, posting a 6% increase in its treasury and trade solutions unit.

In conclusion, the global landscape of trade finance is characterized by stability in Europe and substantial growth in the Middle East and Brazil. As US trade policies continue to evolve, banks are adjusting their strategies and focusing on regional opportunities. While the outlook for 2025 contains uncertainties, particularly regarding US trade relations, banks in various regions are positioned to capitalize on emerging trends and diversify their portfolios.

Original Source: www.gtreview.com