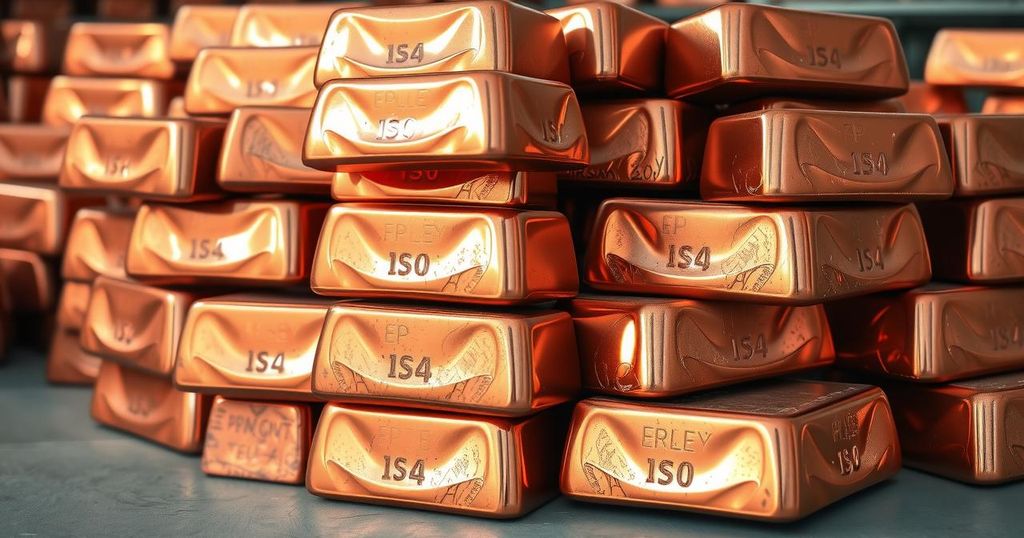

Copper Prices Reach Multi-Month Highs Amid Tariff Concerns and Demand Growth

Copper prices rose to multi-month highs amid U.S. tariff concerns and improved demand in China. Copper reached $9,769 per ton on the London Metal Exchange and $4.86 per pound on Comex. The sentiment improved following a ceasefire proposal in Ukraine and lessened U.S.-Canada trade tensions.

On Wednesday, copper prices reached multi-month highs, driven by anticipated U.S. tariffs and improved demand indicators from China. The London Metal Exchange reported a 1.1% increase in three-month copper prices, reaching $9,769 per ton, while U.S. Comex copper futures rose 1.9% to $4.86 per pound, the highest levels seen since May 2022.

The new U.S. tariffs of 25% on steel and aluminum initiated a probe into potential tariffs on copper, prompting American traders to increase their stockpiles. “There’s a lot of copper being shipped to the U.S., depleting the inventory levels elsewhere and underpinning prices outside of the U.S.,” stated Ole Hansen, head of commodity strategy at Saxo Bank.

Investor sentiment showed significant improvement following a possible ceasefire agreement in Ukraine and the easing of tensions in U.S.-Canada trade relations. European stock markets responded positively, as Ukraine expressed readiness to consider a U.S. ceasefire proposal.

In China, the Shanghai Futures Exchange reported a 2.08% rise in copper prices due to encouraging demand prospects. The ANZ Downstream Copper Demand Indicator indicated positive growth, with heightened production in grid infrastructure and electric vehicle sectors.

Zinc emerged as a notable performer, gaining 1.5% to $2,956 per ton following production cuts announced by Nyrstar. Other metals also demonstrated positive movement, with aluminium rising to $2,719.50 per ton, nickel increasing to $16,720, lead climbing to $2,071.50, and tin reaching $33,450.

In summary, copper prices have surged to their highest levels in several months due to anticipated U.S. tariffs and better demand from China. The market reacted positively to potential geopolitical stability, leading to increased investor confidence. Other metals also experienced gains, indicating an overall upward trend in the commodities market.

Original Source: www.tradingview.com