UK IPO Market Deteriorates, Falling Behind Oman and Malaysia in Rankings

The UK IPO market has significantly declined, raising only $1 billion this year and ranking 20th globally, trailing Oman and Malaysia. Factors such as low valuations and investor caution are impacting the market’s health. Meanwhile, IPO activity is thriving elsewhere, particularly in the Middle East. Major reforms have been introduced to revive the UK market, but many firms are opting for listings in the US instead, highlighting a pressing need for revitalization.

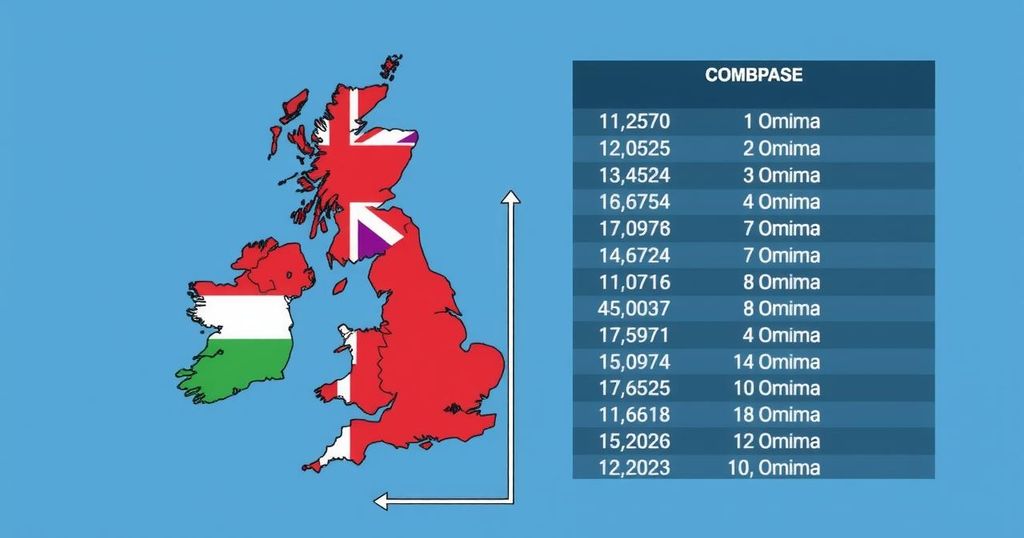

The UK stock market has continued to experience significant challenges in its initial public offerings (IPOs), having raised only $1 billion this year, a 9% decline from the previous year. This downturn has relegated the UK to 20th place in global IPO rankings, trailing behind smaller markets in Oman, Malaysia, and Luxembourg. Historically, London was among the top five IPO destinations worldwide. Factors contributing to this decline include low valuations, an increasingly risk-averse investor base, and fierce competition from burgeoning financial centers. This year, approximately a dozen firms have gone public in London, but none featured among the global top 100 listings.

Additionally, a considerable number of companies are opting to delist from the London exchange, citing low liquidity and poor market conditions. Industry leaders suggest that the UK must make further reforms to revitalize its investment environment. In contrast, substantial IPO activity has surged in the Middle East and Asia, which captured over half of this year’s global fundraising, aided by both local and international interest. High-profile IPOs in these emerging markets contrast starkly with London’s dwindling appeal.

Despite the adverse conditions, there have been some indications of potential recovery. The UK has implemented notable changes to its listing rules, aiming to attract more tech companies and improve market vibrancy. Nonetheless, many British firms are currently opting for listings in the United States for better valuation opportunities. As stakeholders await signs of recovery in the UK market, experts call for renewed investment enthusiasm and growth momentum to bring London’s IPO scene back to prominence.

The article discusses the current state of the UK stock market, particularly its performance in initial public offerings (IPOs). It highlights a significant decline in fundraising, which has seen the UK fall in global rankings beneath smaller markets such as Oman and Malaysia. This trend reflects broader challenges facing the UK, including low investor confidence and competition from other international financial markets. While regulatory changes have been introduced to bolster the market, companies are increasingly favoring listings elsewhere, particularly in the United States. The article underscores the necessity for revitalization measures to restore investor enthusiasm and market vitality.

In conclusion, the UK stock market faces significant challenges in its IPO sector, experiencing a decline in capital raised and a drop in global rankings. While the introduction of new regulatory measures offers some hope for revitalization, the strong performance of emerging markets and the appeal of foreign exchanges present formidable competition. To regain its status as a premier IPO destination, the UK must foster a more favorable environment for public offerings, encouraging investment and enhancing market attractiveness.

Original Source: www.livemint.com