Nigeria and South Africa: Pioneers in Cryptocurrency Ownership Globally

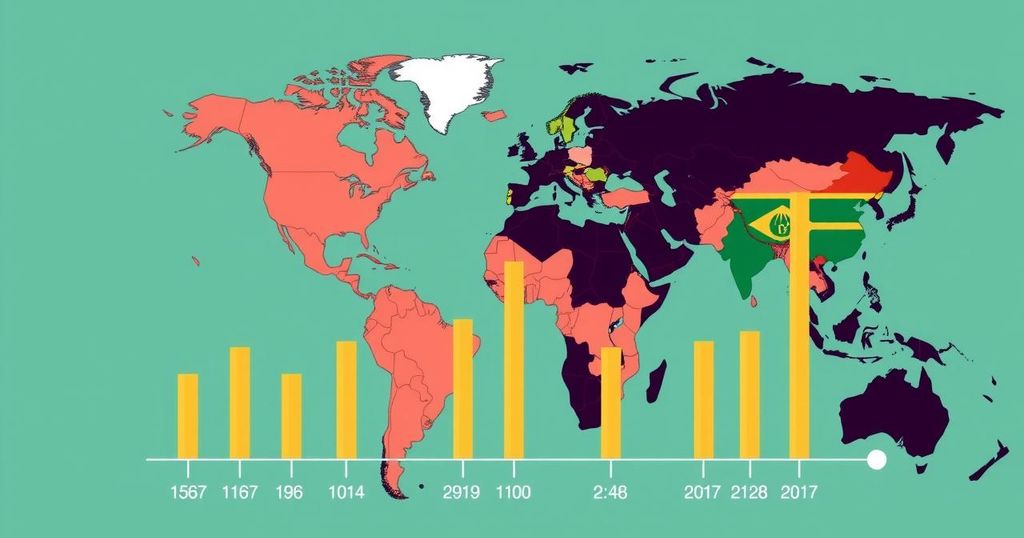

A Consensys report identifies Nigeria and South Africa as leaders in global cryptocurrency ownership, with 73% and 68% ownership rates, respectively. Practical applications driving this trend include inflation hedging and business payments. Despite low transaction volume globally, the continent saw $125 billion in cryptocurrency transactions between July 2023 and June 2024, with widespread awareness noted.

A recent report by Consensys has positioned Nigeria and South Africa at the forefront of global cryptocurrency ownership, showcasing ownership rates of 73% and 68%, respectively. This heightened adoption within the African continent is largely driven by practical applications of cryptocurrency, which include using it as a hedge against inflation, facilitating business payments, and conducting small retail transactions. Additionally, the report complements findings from Chainalysis, indicating that sub-Saharan Africa is leading the world in decentralized finance (DeFi) adoption, primarily due to the low penetration of traditional banking services.

Cryptocurrency usage in Africa is evolving significantly, with Nigeria and South Africa emerging as leaders in ownership rates. Despite the continent’s extensive adoption, it still represents a mere 2.7% of the global transaction volume. This discrepancy highlights the economic scale of the region. The remarkable growth in the use of cryptocurrency resulted in an influx of $125 billion in on-chain value between July 2023 and June 2024. Furthermore, there is a striking level of awareness regarding cryptocurrency in these countries, with nearly universal familiarity reported.

In summary, Nigeria and South Africa are becoming notable players in the global cryptocurrency landscape, propelled by practical applications and a growing awareness among their populations. Despite only accounting for a small share of global transaction volumes, the substantial on-chain value transactions indicate a promising future for cryptocurrency in Africa, particularly in the realms of financial inclusion and decentralized finance.

Original Source: iafrica.com